Entrepreneurs are turning to offshore trusts asset protection for risk mitigation.

Entrepreneurs are turning to offshore trusts asset protection for risk mitigation.

Blog Article

Recognizing Offshore Trust Possession Protection: Provider to Safeguard Your Possessions

If you're looking to secure your wealth, comprehending offshore trust possession security is crucial. These counts on can offer an efficient shield against lenders and legal claims, ensuring your assets remain risk-free.

What Is an Offshore Trust Fund?

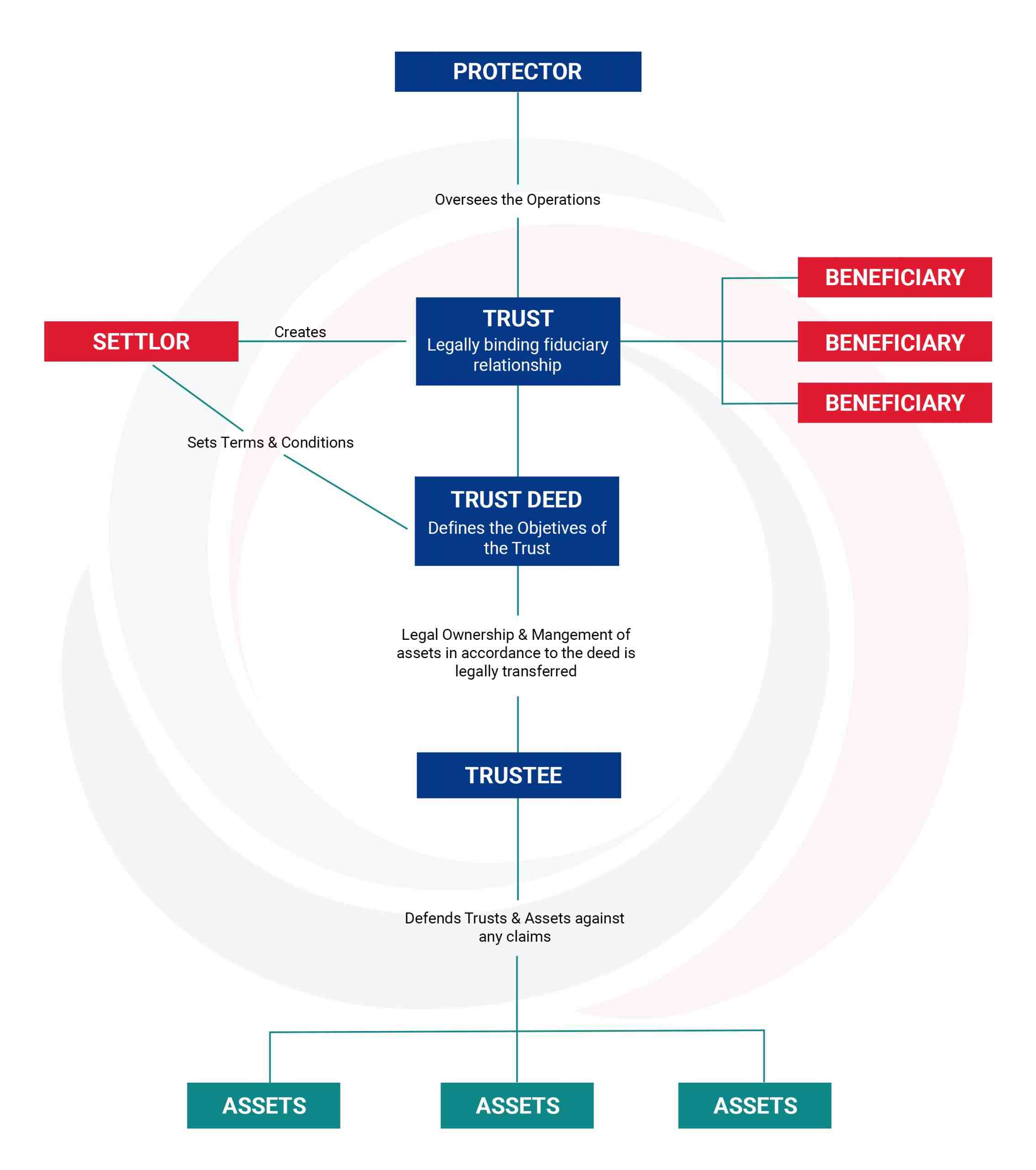

An offshore trust is a legal setup where you position your possessions in a trust fund took care of outdoors your home country. This setup allows you to divide your possessions from your personal estate, offering an extra layer of monitoring and defense. When you establish an offshore trust, you appoint a trustee that manages the possessions according to your specified terms. This can aid you preserve control while benefiting from the advantages supplied by the territory where the trust fund is established.

You can select numerous sorts of offshore trust funds, such as optional or set trusts, based upon your monetary objectives. Furthermore, you can assign recipients who will certainly get the trust fund's possessions in the future. Offshore depends on can additionally provide privacy, as they often secure your financial information from public examination. Overall, recognizing how an overseas trust fund works encourages you to make informed decisions concerning protecting your riches effectively.

Advantages of Offshore Trusts for Asset Security

An additional substantial advantage is tax obligation efficiency. Depending on the jurisdiction, you might gain from favorable tax treatments, which can help you preserve more of your wide range. Offshore trusts can additionally supply adaptability pertaining to property monitoring and circulation, enabling you to tailor the depend your certain requirements and objectives.

Kinds Of Offshore Depends On

When taking into consideration overseas trust funds, you'll encounter various types, primarily revocable and irrevocable trusts. Each serves various purposes and offers distinct degrees of property defense. Furthermore, recognizing optional and non-discretionary counts on is necessary for making notified decisions concerning your estate preparation.

Revocable vs. Unalterable Counts On

Recognizing the distinctions in between revocable and irreversible depends on is crucial for any person taking into consideration overseas asset protection. A revocable trust fund permits you to preserve control over the assets, allowing you to change or dissolve it anytime. This flexibility can be valuable if your conditions alter. Nevertheless, because you preserve control, lenders may still access these properties.

On the other hand, an irreversible trust fund eliminates your control once developed, making it more safe from creditors. You can not change or withdraw it without the authorization of the beneficiaries, which supplies stronger possession protection. Selecting in between these types depends upon your economic goals and run the risk of resistance, so weigh the benefits and drawbacks carefully before deciding.

Discretionary vs. Non-Discretionary Counts On

Discretionary and non-discretionary trust funds offer various functions in offshore possession protection, and recognizing which kind fits your needs can make a considerable difference. In a discretionary trust, the trustee has the adaptability to choose how and when to distribute properties to recipients. Eventually, understanding these differences aids you tailor your offshore trust approach to properly secure your assets and achieve your economic objectives.

Secret Providers Used by Offshore Count On Providers

Several offshore trust carriers use a variety of crucial services made to safeguard your assets and assurance compliance with worldwide regulations. One crucial solution is possession monitoring, where specialists manage your investments to take full advantage of returns while minimizing dangers. They additionally give depend on management, ensuring your depend on runs smoothly and sticks to lawful requirements.

Tax obligation preparation is another vital solution, helping you enhance your tax scenario and avoid unnecessary obligations. In addition, these service providers commonly use estate planning support, assisting you in structuring your trust fund to meet your long-term goals and protect your legacy.

Finally, many deal coverage and conformity services, ensuring you satisfy annual declaring demands and keep openness with governing bodies. By taking benefit of these services, you can enhance the protection of your assets and achieve comfort understanding that your monetary future is in capable hands.

Selecting the Right Jurisdiction for Your Offshore Count On

When choosing the best jurisdiction for your offshore trust fund, you need to ponder the property defense regulations, tax obligation ramifications, and the overall track record of the location. Each jurisdiction uses special benefits and challenges that can greatly impact your trust's effectiveness. By recognizing these variables, you can make an extra educated decision that straightens with your economic objectives.

Jurisdictional Asset Protection Rules

Picking the appropriate territory for your offshore trust is important, as it can significantly influence the degree of asset defense you obtain. Different territories have differing asset defense legislations, which can secure your properties from lenders and lawful insurance claims. Search for nations with strong lawful frameworks that prioritize depend on privacy and deal beneficial regulations. Think about jurisdictions understood for their robust monetary systems, like the Cayman Islands or Nevis, as they provide a strong legal foundation for property protection. Confirm the picked area has laws that protect against required heirship cases and impose limitations on lenders. By completely looking into and selecting the ideal jurisdiction, you can boost the protection of your possessions and appreciate peace of mind.

Tax Obligation Effects and Advantages

How can comprehending tax ramifications improve the advantages of your overseas trust fund? By selecting the appropriate territory, you can possibly reduce your tax liability and maximize your possession protection. offshore trusts asset protection. Some overseas locations offer desirable tax obligation prices or perhaps tax obligation exceptions for trust funds, allowing your assets to grow without heavy tax

Furthermore, comprehending regional tax legislations can help you structure your count on effectively. You'll want to take into consideration how income generated by the trust fund is tired and recognize any type of reporting demands.

Legal Security and Online Reputation

As you discover alternatives for your overseas trust, comprehending the legal stability and online reputation of possible territories is necessary. A territory with Discover More a strong lawful structure guarantees your assets are shielded and much less prone to political or economic instability. Examine the nation's laws regarding property security and trust fund administration; some jurisdictions supply positive regulations, while others might have restrictive practices.

This persistance will help you select a place that not just safeguards your properties but likewise supplies tranquility of mind for the future. Inevitably, an audio option enhances your count on's performance and safety and security.

Legal Factors To Consider and Conformity

While developing an overseas trust can provide considerable property defense advantages, it's vital to navigate the intricate legal landscape with care. You'll need to understand the legislations regulating count on both your home nation and the territory where the trust is established. Compliance with tax policies is crucial, as falling short to report overseas accounts can lead to severe penalties.

Additionally, you should understand international treaties and agreements that might influence your trust's procedures. Each nation has special demands for paperwork, reporting, and governance, so you'll intend to seek advice from with lawful and financial experts experienced in overseas trust funds.

Remaining compliant isn't practically staying clear of lawful difficulties; it also assures that your properties are secured according to the law. By focusing on lawful factors to consider and compliance, you safeguard your wide visit our website range and preserve comfort as you browse this elaborate procedure.

Actions to Developing an Offshore Count On

Establishing an overseas count on involves numerous crucial steps that can aid enhance the process and assure your assets are legitimately safeguarded. First, you'll require to choose a trustworthy jurisdiction that supplies positive laws for possession protection. Research study various countries and take into consideration aspects like tax effects and legal security.

Following, select a reliable trustee. This could be a banks or an individual skilled in taking care of counts on. Ensure they understand your goals and can follow local policies.

As soon as you've chosen Visit Your URL a trustee, you'll prepare the trust fund document. This must detail your objectives and define recipients, assets, and distribution techniques. Consulting with a lawful specialist is vital to make sure your record meets all requirements.

Often Asked Inquiries

Can I Set up an Offshore Count On Without a Monetary Consultant?

You can establish up an overseas trust fund without a monetary consultant, yet it's risky. You might miss out on important legal demands or tax obligation effects. Research completely, and think about getting in touch with professionals to ensure every little thing's done appropriately.

How Much Does It Expense to Preserve an Offshore Depend On Each Year?

Maintaining an offshore count on every year can cost you anywhere from a couple of hundred to numerous thousand bucks. Variables like territory, intricacy, and trustee costs affect these prices, so it's sensible to spending plan accordingly.

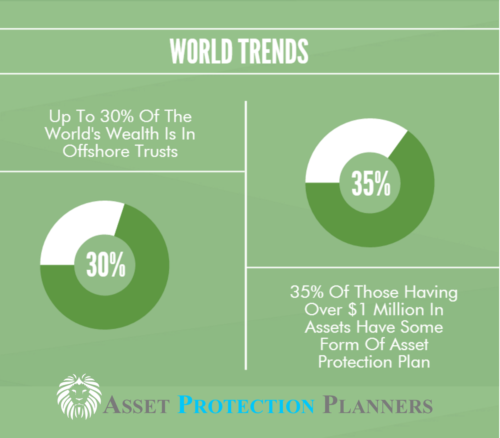

Are Offshore Trusts Only for Wealthy Individuals?

Offshore counts on aren't just for affluent individuals; they can profit any person looking to shield properties or plan for the future. They supply personal privacy and versatility, making them obtainable for a more comprehensive series of financial circumstances.

What Occurs if I Change My Mind Concerning the Trust?

If you change your mind about the trust, you can frequently change or withdraw it, depending on the trust's terms. offshore trusts asset protection. Speak with your lawyer to assure you comply with the appropriate legal treatments for modifications

Can I Accessibility My Assets in an Offshore Trust Fund at Any Time?

You can not access your possessions in an offshore trust at any kind of time. Normally, these depends on restrict your control to shield possessions. You'll need to adhere to the depend on's guidelines to accessibility funds or property.

Verdict

To sum up, recognizing overseas count on asset security can be a game-changer for guarding your wealth. Keep in mind, developing an overseas trust fund isn't simply concerning protection; it's regarding guaranteeing your economic future is protected.

Report this page